In Uganda, the advent of Electronic Fiscal Receipting and Invoicing Solutions (EFRIS) represents a transformative leap forward in tax administration, with tangible benefits reverberating across society. Let’s explore how EFRIS is revolutionizing Uganda’s fiscal landscape and positively impacting its population:

1. Streamlined Transactions: Businesses in Uganda, like elsewhere, are embracing EFRIS to streamline transactions. For instance, a local retail chain in Kampala has adopted EFRIS, replacing manual receipting with digital solutions. This has not only expedited the checkout process but also improved customer satisfaction through faster service.

2. Enhanced Transparency: EFRIS promotes transparency by providing consumers with verifiable digital receipts. For example, a consumer purchasing groceries in Entebbe can instantly verify their transaction via SMS or an online portal, ensuring transparency and accountability in every purchase.

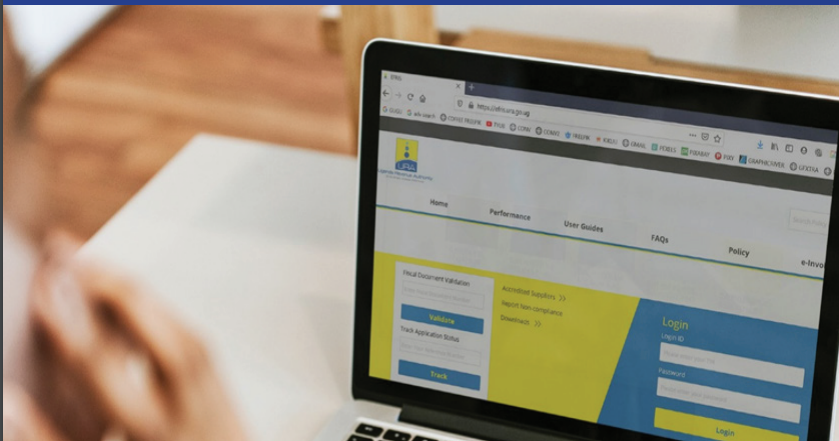

3. Combatting Tax Evasion: Uganda Revenue Authority (URA) has implemented EFRIS to combat tax evasion effectively. By integrating EFRIS into its tax systems, URA can track transactions in real-time, minimizing opportunities for tax evasion. This has led to increased tax compliance and revenue collection, benefiting Uganda’s economy.

4. Boosting Government Revenue: The adoption of EFRIS has significantly boosted government revenue in Uganda. According to URA reports, the implementation of EFRIS has resulted in a notable increase in tax collections, providing the government with additional resources for infrastructure development and public services.

5. Empowering Small Businesses: Small businesses in Uganda are reaping the benefits of EFRIS, which offers user-friendly digital solutions. For example, a local artisan in Jinja can easily generate digital invoices using EFRIS, eliminating the need for costly manual paperwork. This empowerment of SMEs fosters economic growth and entrepreneurship.

6. Environmental Sustainability: EFRIS promotes environmental sustainability by reducing paper usage associated with traditional invoicing methods. With fewer paper receipts being printed, Uganda is moving towards a greener future, contributing to global efforts for environmental conservation.

7. Consumer Protection: EFRIS ensures consumer protection by providing accurate and verifiable receipts. For instance, a shopper in Mbale can dispute a transaction with confidence, knowing that their digital receipt is authenticated by URA, thus fostering trust in the marketplace.

8. Modernization of Tax Systems: Uganda’s adoption of EFRIS exemplifies the modernization of tax systems in the country. By embracing digital innovation, Uganda is aligning its tax administration with global standards, enhancing efficiency, and effectiveness in revenue collection.

In conclusion, Electronic Fiscal Receipting and Invoicing Solutions are bringing tangible benefits to Uganda’s population. From streamlining transactions and enhancing transparency to combating tax evasion and empowering businesses, EFRIS is a catalyst for positive change in Uganda’s fiscal landscape. As the country continues to embrace digital innovation, the future looks promising for a more transparent, efficient, and equitable tax system.